Timely filing calculator

Every resident part-year resident or nonresident individual must file a Pennsylvania Income Tax Return PA-40 when he or she realizes income generating 1 or more in tax even if no tax is due eg when an employee receives compensation where tax is withheldRefer to the below section on TAXATION for. Moneycontrol provides the Complete Guide to Mutual Funds Types of Mutual Funds Best Funds to Buy Mutual Fund Calculator Fund Offers Latest NAVs information and news on the net asset value.

Filing Your Tax Return Don T Forget To Claim Excess Tds Tax Return Tax Income Tax Return

Credit Card Payoff Calculator.

. Filing for bankruptcy can send a good credit score of 700 or above plummeting by at least 200 points. This means after adding VAT the price of a product changed from AED100 to AED105. However an individual is required to pay a late filing fee if heshe is filing belated ITR.

If youre unsure about an expense you can seek unlimited help from the CPAs. All Medicare claims must be filed within one year after the date of service DOS. From there the 05 rate of the late filing penalty increases to 1 per month.

Even with defined married-filing-separately tax brackets and married-filing-jointly tax brackets this is a complex question that doesnt come with a single uniform answer. Heres what you need to know to avoid fees. FlyFin is an AI-powered tax engine designed for freelancers to make taxes effortless.

HRA NSC Rebate under section 89 etc. Right from finding tax write-offs to filing your taxes in just 5 mins FlyFin is the only app you need. All Utilities for ImportExportReport.

Free ITIN application services available only at participating HR Block offices and applies only when completing an original federal tax return prior or current. Theyre always there to help and really make things happen in a professional timely manner. If your score is a bit loweraround 680you can lose between 130 and 150 points.

Use our Probate Fee Calculator to determine what the probate fees charged by BC courts will be. An estimated payment worksheet is available through your individual online services account to help you determine your estimated tax liability and how many payments you should make. See IRSgov for details.

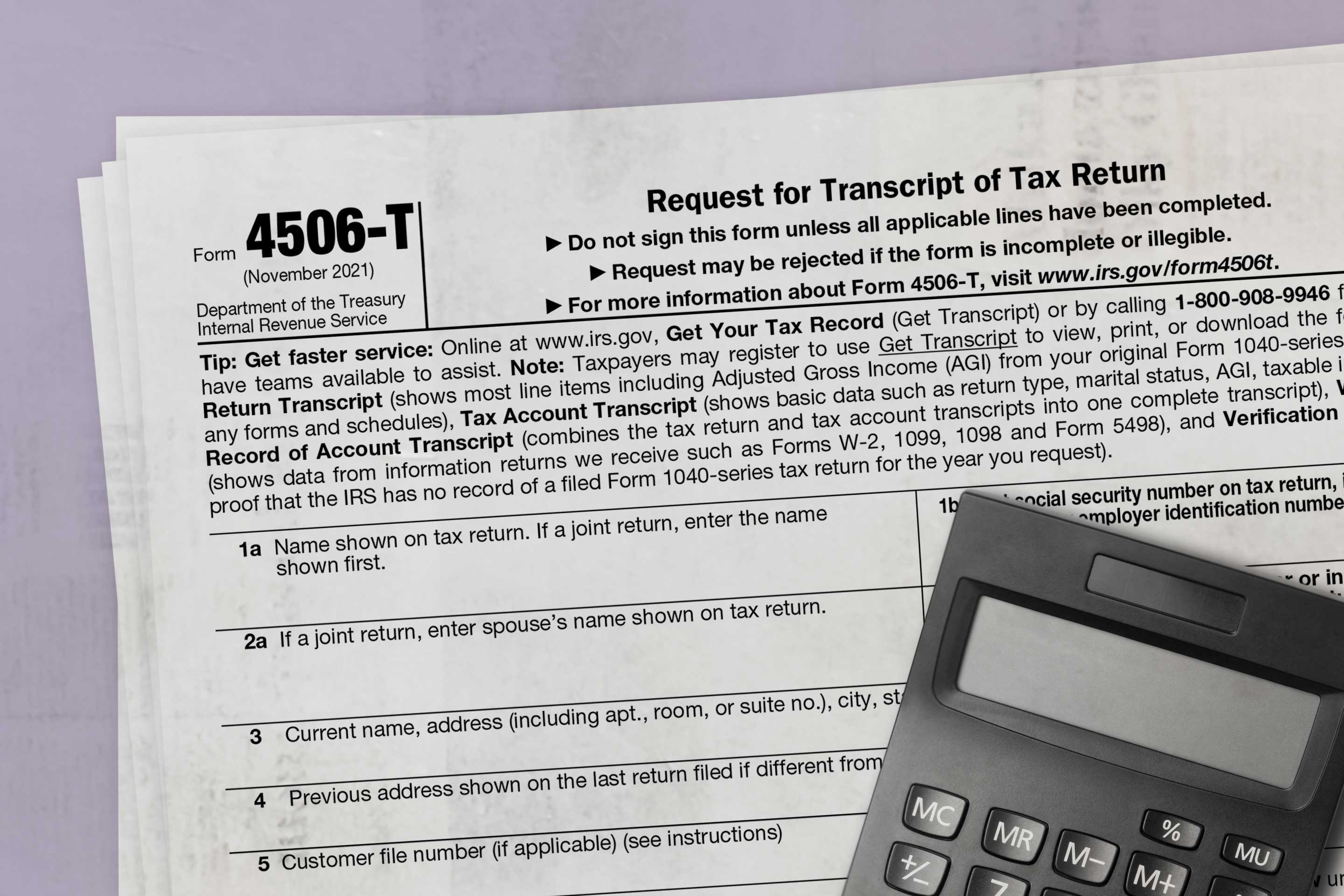

Care Management Medical Preauthorization. Benefit claims under 35 USC. Claims Timely Filing Calculator.

Individual Income Tax Return electronically with tax filing software to amend tax year 2019 or later Forms 1040 and 1040-SR. However you dont get extra time to pay your taxes. This lets us find the most appropriate writer for any type of assignment.

Authorization Coding Req. Access the Vehicle Registration Tax VRT calculator. After 10 days the IRS will issue a final notice of intent to seize property.

A tax extension gives you more time to file your tax return. Generally it is better to file a joint return because taxes are lower for married filing separately and the standard deduction rate is higher said Mark Steber. MyAccount is a single access point to secure online services such as PAYE services including Jobs and Pensions HRI MyEnquiries and more.

The IRS late filing penalty is set to 05 of the tax owed after the due date and for each month the tax remains unpaid up to 25. Filing date of the application. Sign in or register.

120 121 or 365c. Patent term adjustments and extensions under 35 USC. Electronic Certificate of Conformity e-CoC for Vehicle Registration Tax VRT Online services.

31 March 2018 was the deadline for filing belated return for AYs 2018-19 2019-20. Patent term extensions under 35 USC. FAQs on EMI Calculator.

If you timely file Form 4868 you have until October 15 to timely file your return. Are the calculators for home car and personal loans the same. You can file Form 1040-X Amended US.

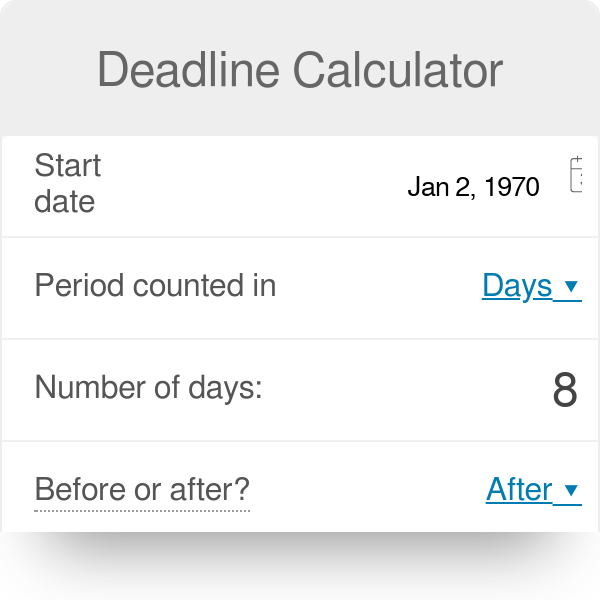

Save More with Timely ITR. Do Not Sell My Info. Enter the DOS to calculate the time limit for filing the claim.

If October 15 falls on a weekend or legal holiday you have until midnight the next business. Brief Overview and Filing Requirements Who Must File. The grant date of the patent.

Timely payment of maintenance fees. It compares the taxes a married couple would pay filing a joint return with what they would pay if they were not married and each filed as single or head of household. Advance Tax and Self-Assessment Tax Calculation.

System links to help determine these factors. Due to federally declared disaster in 2017 andor 2018 the IRS will allow affected taxpayers an extended filing date to file and pay for their 2017 taxes. Our probate lawyers focus only on wills and estates law.

You must pay at least 90 of your tax liability during the year by having income tax withheld andor making timely payments of estimated tax. Use the Claims Timely Filing Calculator to determine the timely filing limit for your service. Our global writing staff includes experienced ENL ESL academic writers in a variety of disciplines.

It develops XML generation Challan e-payment auto-filled JSON Data etc. Responsible use and timely payments can help you down the road to a better. Your best option is a secured credit card.

In most cases they can be the same since all three loans work off the same basic set of information like amount borrowed prepayments tenure interest rates and processing fee however with some calculators there could be a restriction placed on the amount to borrow based on the type of loan. With our VAT Calculator in Dubai If you enter the amount as AED100 and VAT rate as 5 and click on Add VAT the VAT amount becomes AED05 and the total amount is AED105. To determine the 12-month timely filing periodclaims filing deadline we use the From date on the claim.

Additionally consider filing a tax extension and e-file your return by the October deadlineCheck the PENALTYucator for detailed tax penalty fees. Patient seen on 07202020 file claim by 07202021. Calculate taxes- Income Tax Calculator FY 2020-2021 AY 2021-2022.

If you have missed the deadline of filing income tax return ITR for FY 2021-22 ie July 31 2022 then an individual has an option to file the belated ITR. 309 E 8th Street Suite 601 Los Angeles CA 90014. The calculator also excludes temporary provisions that were enacted in 2020 to provide assistance to taxpayers during the pandemic such as the 300 deduction for charitable.

Belated return Penalty for Late Filing of Income Tax Return - Read this article to know how to file belated returns and what are the consequences of late filing of return. Claims received after the date displayed will be considered past the time limit for claim submission. Electronic Data Interchange EDI EDI Support.

Scans all your expenses and finds all tax deductions that apply to you. Gen IT is an income tax software for the fastest e-filing ITRs and computing income.

90 Day Early Filing Date Calculator Christians Law Pllc

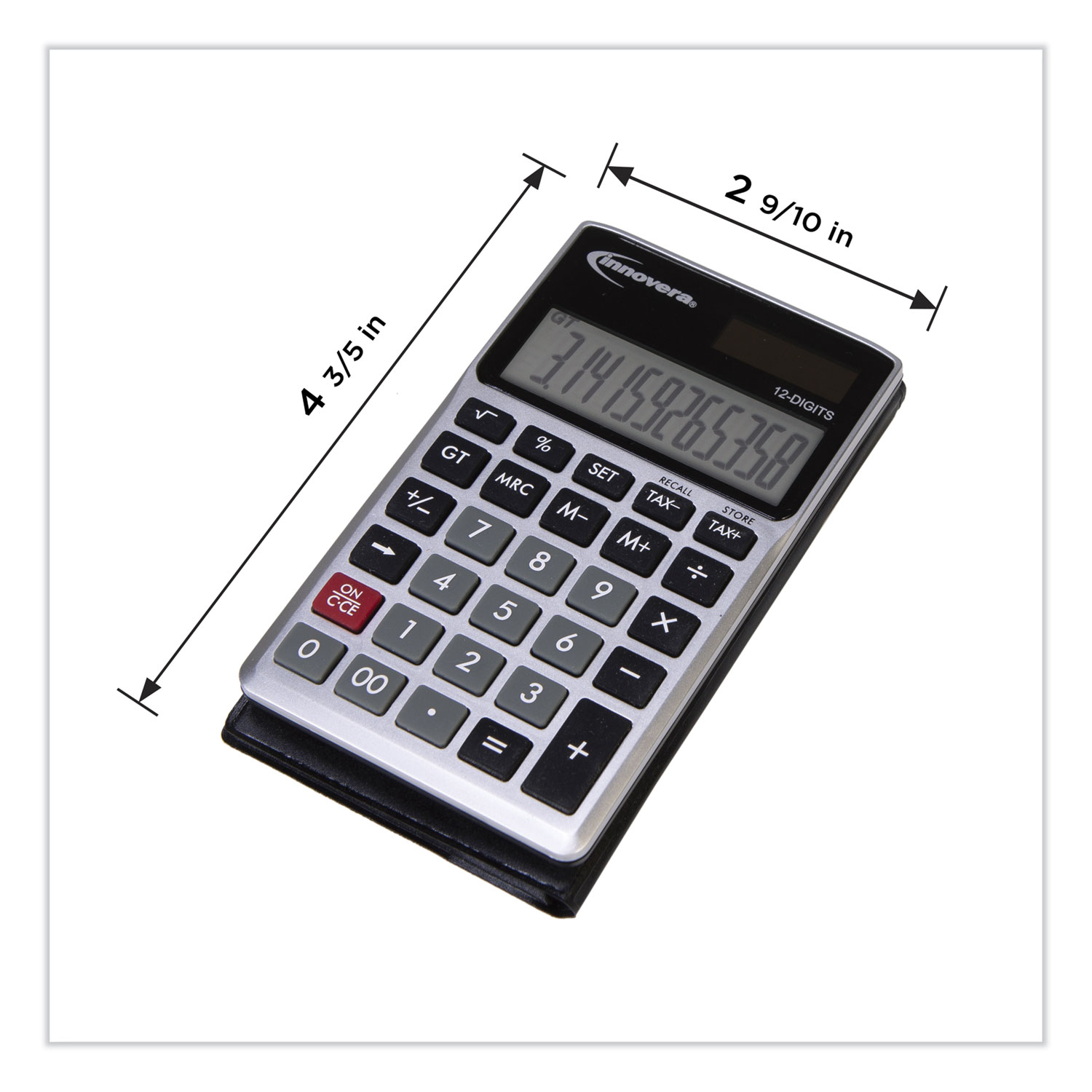

930 2 Scientific Calculator By Victor Vct9302 Ontimesupplies Com

Addressing Notice Of Levy Issues To Improve Reimbursements Filing Taxes Revenue Cycle Improve

417 Function Advanced Scientific Calculator 15 Digit Lcd Zerbee

How To File Back Taxes Money

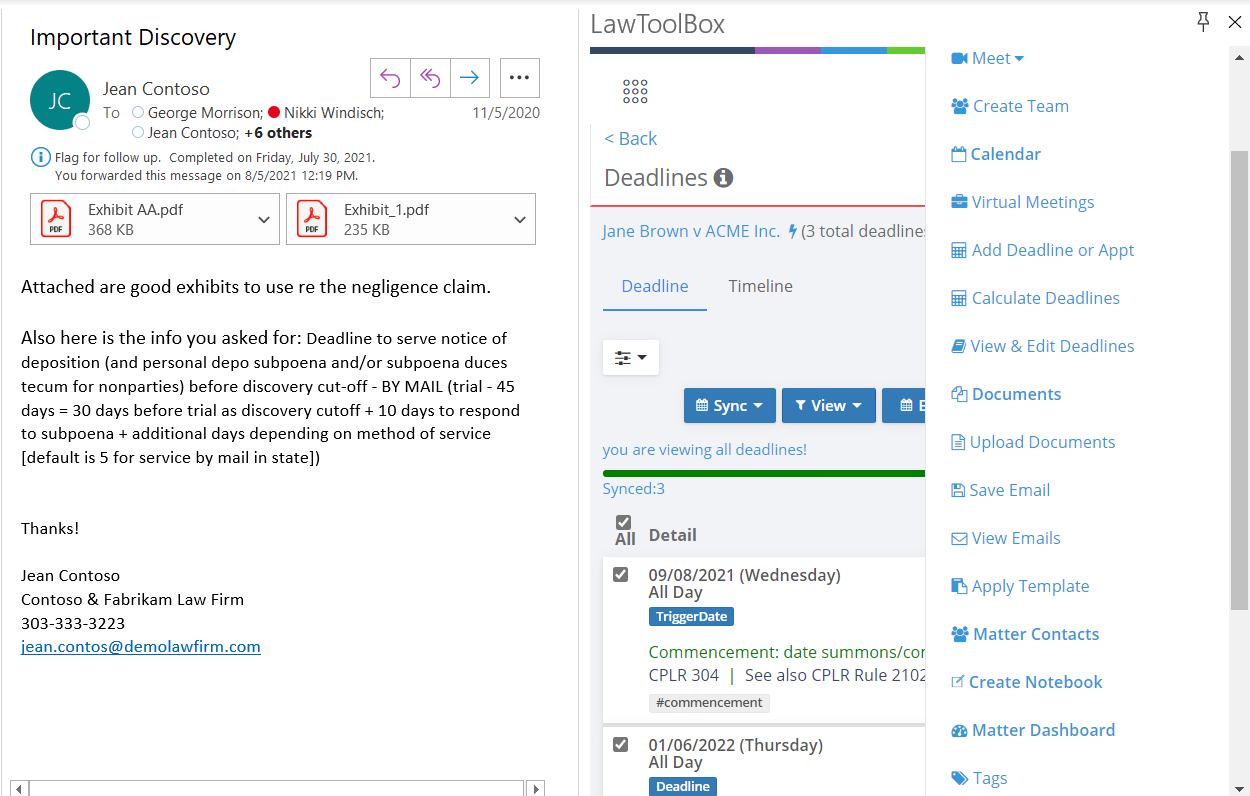

Deadline Calculator Court Date Calculator Legal Deadline Calculator

Deadline Calculator Court Date Calculator Legal Deadline Calculator

Online Income Tax Return Filing Procedure Documents Income Tax Return Income Tax Tax Return

Irs Penalty And Interest Calculator 20 20 Tax Resolution Tax Pros

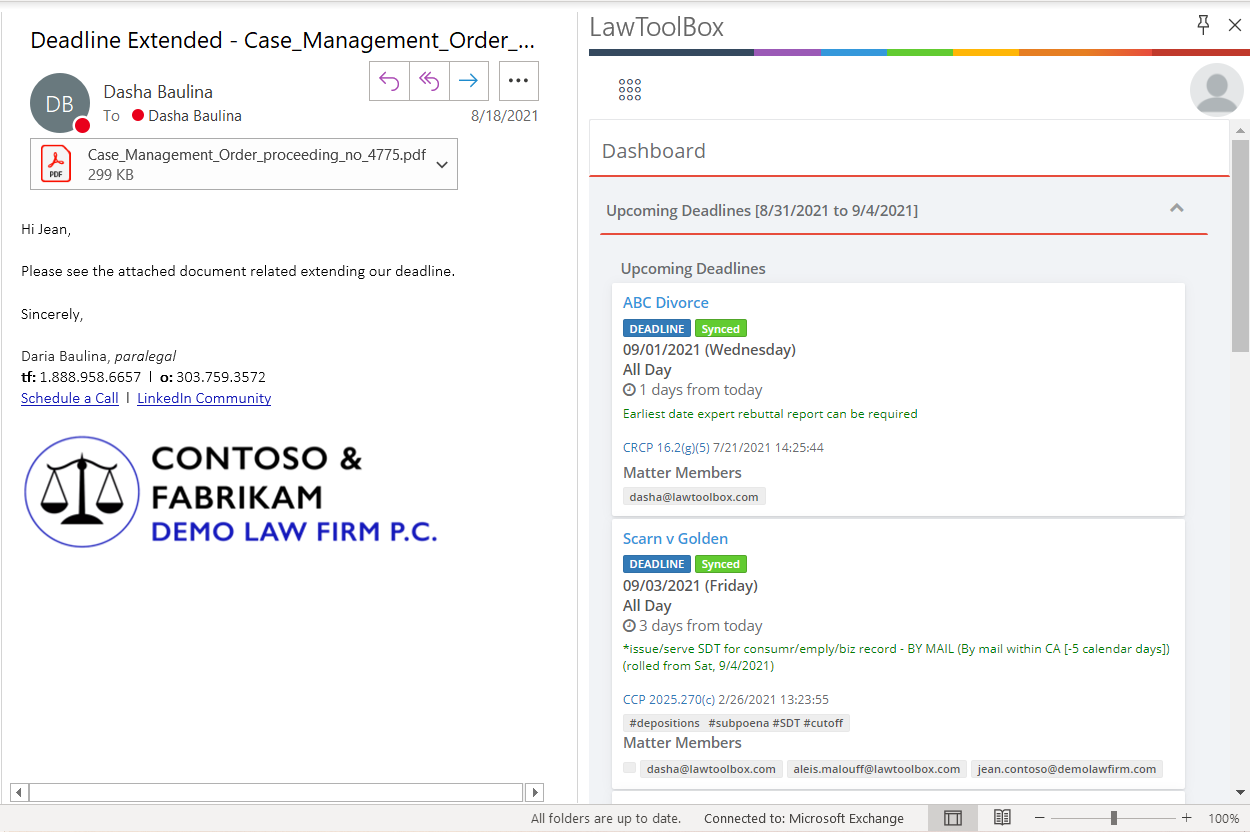

15922 Pocket Calculator 12 Digit Lcd Zerbee

Calculated Construction Master Pro Calculator Save At Tiger Supplies

Filing Of Tax Returns Is An Important Thing And A Little Negligence Can Lead Taxpayers To Several Troubles We Have Seen People Tax Preparation Tax Return Tax

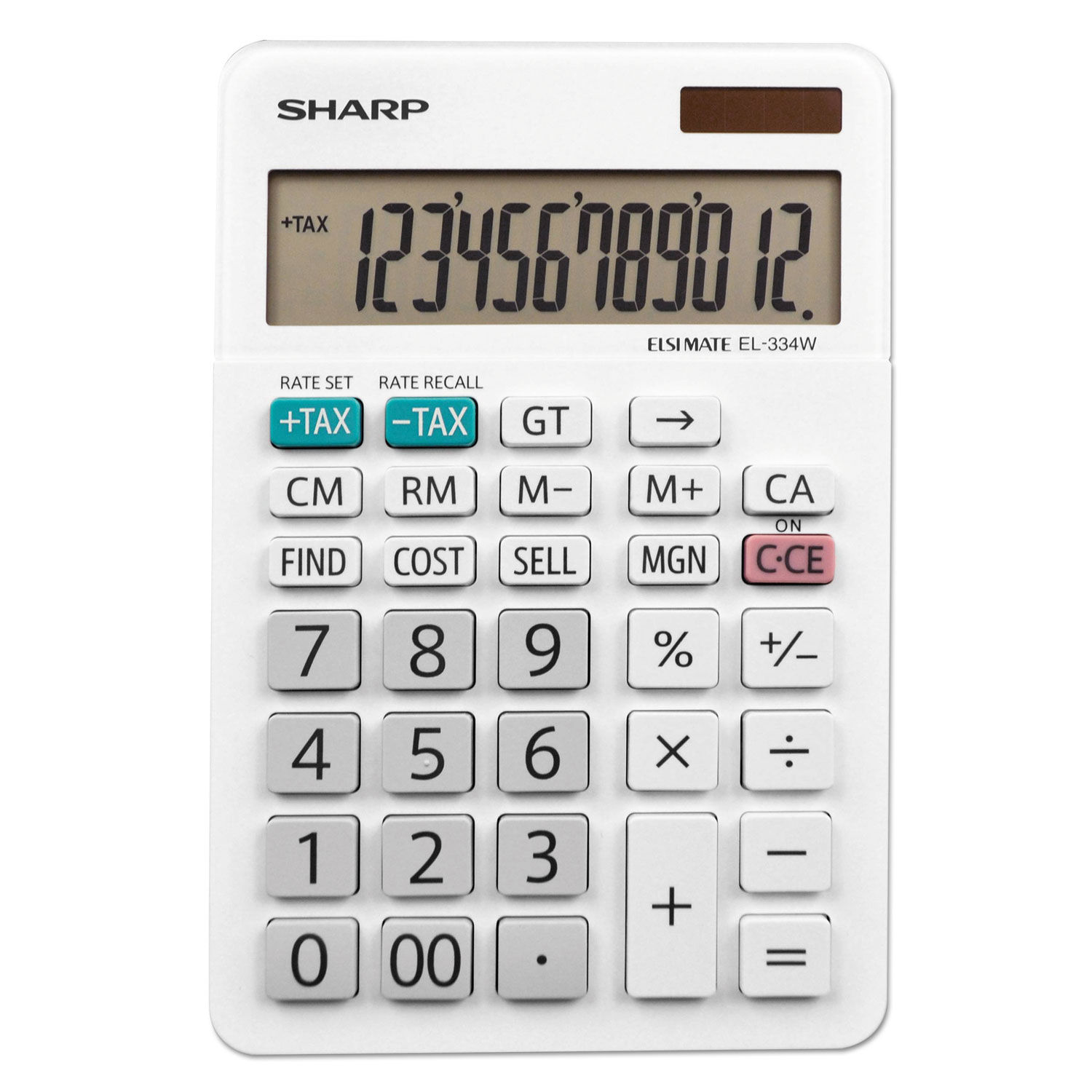

El 334w Large Desktop Calculator By Sharp Shrel334w Ontimesupplies Com

Texas Instruments Ti 34 Multiview Scientific Calculator Zerbee

Texas Instruments Ti 34 Multiview Scientific Calculator Zerbee

Deadline Calculator

Mp49 Dii 14 Digit Desktop Calculator Black Red Print 4 8 Lines Sec Zerbee